Mortgage Brokers for First Time Buyers

We help First Time Buyer dreams become reality!

DOWNLOAD FREE FIRST TIME BUYER PACK

Want a FREE First Time Buyer Pack ?

Click below to download and discover our

FIRST TIME BUYER SECRETS to Mortgage Success.

WHAT DO MORTGAGE CHAIN OFFER ?

See below for details on all the first-time buyer services we offer.

Mortgage Broker Service

Traditional First-time buyer mortgages, shared ownership and help to buy are some of the full range of first-time buyer services we offer. First-time buyer mortgages for employed, self-employed, limited companies and contractors.

Remortgage Broker

Service

We can help first time buyers looking to remortgage for the first time as well as offering traditional remortgage services to homeowners.

Includes product transfers and raising finance via a secured loan.

Virtual Mentorship

Programme

PREPARE. APPLY. SUCCEED.

Check out our brand-new online course, first-time buyer expert, helping you prepare for mortgage success as a first-time buyer.

Onboarding

Service

If you have already had an appointment with us and would like to on-board, or if you could want to skip the initial meeting and on-board, have your documents checked and a mortgage and solicited quote recommended, faxing so you are mortgage ready use this service by clicking the link below.

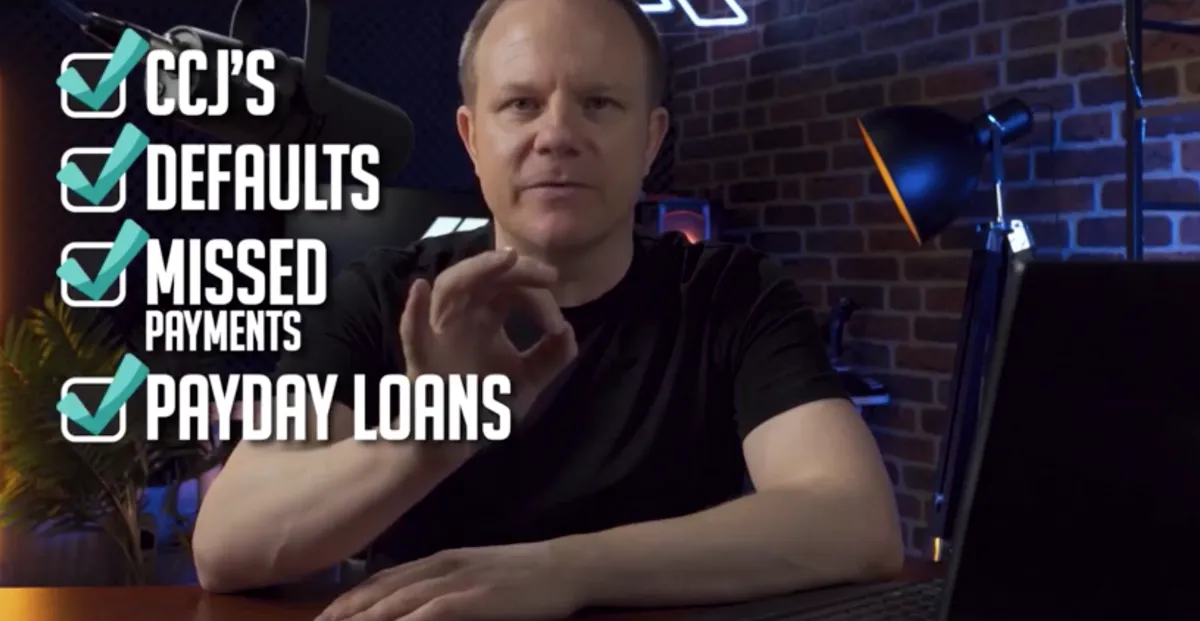

Adverse Credit ?

We are currently providing a free mentorship programme which will help you understand your mortgage options and the amount of deposit you will need for a bad credit mortgage. Click the link below to download our free online course, Bad Credit File Expert - Lite.

Full Suite of

Services

For our full suite of services we offer to first-time buyers, click on the link below. From help for non-UK nationals, buying non-standard properties, obtaining solicitor, life cover and house insurance quotes. We have it all!

WHAT DO OUR CURRENT CLIENTS SAY?

GET STARTED TODAY!

Book now to prepare, apply & succeed when applying for your first mortgage!

Latest Expert Articles...

Mortgages for First time Buyers in the UK

“Unlocking the Door to Homeownership: A Comprehensive Guide to Mortgages for First-Time Buyers in the UK.” - Alex Kerr

Introduction:

Finding your dream home is an exciting journey, but navigating the world of mortgages as a first-time buyer in the UK can be overwhelming. That's why we've created this comprehensive guide to help unlock the door to homeownership. In this article, we will walk you through everything you need to know about mortgages, from understanding the different types available to demystifying the jargon and providing practical tips for getting approved. Whether you're unsure about the difference between fixed-rate and variable-rate mortgages or want to know how to improve your credit score to secure a better deal, we've got you covered.

Our aim is to empower you with the knowledge and tools you need to confidently take the first steps towards owning your own home. We understand that buying a property is a significant financial decision, and we want to ensure that you are well-informed every step of the way. So if you're ready to embark on your homeownership journey, let's dive into this comprehensive guide to mortgages for first-time buyers in the UK.

Here are all of your options when considering a mortgage for first-time buyers in the UK

Unlocking the Door to Homeownership: A Comprehensive Guide to Mortgages for First-Time Buyers in the UK

Finding your dream home is an exciting journey, but navigating the world of mortgages as a first-time buyer in the UK can be overwhelming. That's why we've created this comprehensive guide on mortgages for first-time buyers to help unlock the door to homeownership.

In this article, we will walk you through everything you need to know about mortgages, from understanding the different types available to simplifying your mortgage options and getting approved. Whether you're unsure about the difference between fixed-rate and variable-rate mortgages or want to know how to improve your credit score to secure a better deal, we've got you covered. Our aim is to give you with the knowledge and tools you need to confidently take the first steps towards owning your first home.

We understand that buying a property is a significant financial decision, and we want to ensure that you are well-informed every step of the way. So if you're ready to move forwards on your homeownership journey, let's dive into this comprehensive guide to mortgages for first-time buyers in the UK.

Types of Mortgages Available for First-Time Buyers

As a first-time buyer, it's important to understand the different types of mortgages available to you. The two main types are fixed-rate mortgages and variable-rate mortgages. A fixed-rate mortgage offers the security of a set interest rate for a specific period, usually between two to five years. On the other hand, a variable-rate mortgage means that the interest rate can fluctuate, which can be beneficial if rates decrease but can also increase your monthly payments if rates rise.

Fixed-rate mortgages: a fixed rate means that the mortgage rate of the product and the monthly payment will stay exactly the same for the length of the chosen fixed rate period. This means you know exactly what you're paying each month and the length of the time that fixed payment will stay the same for. A fixed-rate provide security and stability as you know exactly where you are. With most mortgage lenders you can choose a fixed rate for 2 years, 3 years and 5 years with many lenders also providing 10 year fixed rates.

First-time buyers will often opt for fixed-rate mortgages if they know that they will be staying in the property for at least the length of the fixed rate mortgage. If for example you knew you only wanted to stay in the property short-term, such as 6 to 12 months or you knew that you would be paying the mortgage off in full within this timeframe then a fixed rate might not be best suited as you would have penalties to pay if you wanted to leave the fixed rate early.

Variable-rate mortgages: Variable-rate mortgages mean they can go up or down in rate, usually on a monthly basis. Some variable-rate mortgages are linked to the Bank of England base rate, which will follow the movements of the Bank of England. So if the Bank of England increase rates by 0.5%, that means your rate will also increase by 0.5%. Variable-rate mortgages that are linked to the Bank of England base rate are called "tracker mortgages". There are other variable-rate mortgages such as discount mortgages which is where the mortgage lender provides a discount on their standard variable rate of interest and rates will fluctuate in line with the changes on their variable-rate. Other variable-rate mortgages include offset mortgages, where you can offset your savings against the mortgage and therefore not pay interest on the amount equivalent to your savings balance and flexible mortgages which do not have any type of restrictions or tie-ins.

Variable-rate mortgages are more of a gamble and are often chosen for small mortgage balances and short-term mortgages. For example if you wanted to buy a rundown property, renovate the property for a profit and sell it with the idea of using that profit for your deposit on your next property, you may choose a variable-rate with no tie-ins so you can pay the mortgage off at any point without penalty.

Mortgage Eligibility Criteria and Requirements

Before applying for a mortgage, it's crucial to understand the eligibility criteria and requirements set by mortgage lenders. These criteria typically include factors such as your income, employment status, credit history, and the size of your deposit. Mortgage lenders will assess your ability to make repayments based on these factors, so it's essential to have all the necessary documentation ready. Success with mortgages for first-time buyers in the UK is all about preparation and not cutting corners. The areas which will carry the most significant weight in regards to your mortgage application will be your continuous employment history, credit score and debt to income ratio. If you can have at least 12 months continuous employment history, within the same line of work, then this will strengthen your chances. It's vital to have a good credit score if you want to be successful with a high street mortgage lender.

This means checking your credit file for missed payments and defaults. Having a low debt to income ratio is also something that mortgage lenders look for. Ideally you want to keep this at 20% or lower. Even though mortgage lenders may allow a higher ratio, it's advisable to keep this as low as possible. If your income is £40,000 per annum and your total debt is £10,000, then this means your debt to income ratio is 25%. (40,000 / 10,000)

Assessing Your Financial Situation: How Much Can You Afford?

Determining how much you can afford to borrow is a crucial step in the mortgage process. To do this, you'll need to assess your financial situation, including your income, expenses, and any existing debts. It's important to be realistic and consider not only your current financial circumstances but also any potential changes in the future, such as career progression or starting a family. It's not as simple as just multiplying your income by 4.5 any more. When considering mortgages for first-time buyers, there's multiple factors that now come into account such as the cost of living and inflation, how much you earn per year, and the amount of deposit you have. It is vital to understand your affordability before you start looking for properties on the market. At Mortgage Chain, part of our onboarding process is that we assess your affordability with over 70 mortgage lenders.This is when we are researching the mortgage market and looking for the best deal for your circumstances. This is so when you look for properties you know exactly your budget.

The Importance of Credit Scores in Mortgage Applications

Your credit score plays a significant role in mortgage applications. Lenders use your credit score to assess your creditworthiness and determine the interest rate and terms they offer you. It's essential to review your credit report, address any errors or issues, and take steps to improve your credit score if necessary. This can include paying bills on time, reducing credit card balances, and avoiding new credit applications. It's also very important not to take out any new lines of credit before or during a mortgage application. Mortgage lenders may re-credit score you at any point, and your credit balances and monthly payments at the point of mortgage application is assessed. It's very important that these figures do not increase as it will reduce the amount you can borrow which could lead to a declined mortgage.

Saving for a Deposit: Tips and Strategies

Saving for a deposit is a crucial aspect of homeownership. The larger your deposit, the lower your mortgage loan-to-value ratio, which can result in better interest rates and lower monthly payments. It's essential to set a savings goal, create a budget, and explore strategies such as government schemes or help from family members to boost your savings.

A mortgage lender has introduced a "no deposit mortgage" however you need to meet certain criteria in order to qualify for this mortgage. You will need a minimum of a 5% deposit in order to apply for a mortgage. First time buyers in the UK can also take advantage of a Lifetime Isa, which will pay a 25% bonus towards the process.

The Process of Applying for a Mortgage

The process of applying for a mortgage can seem daunting, but understanding the steps involved can help ease your worries. It typically involves gathering all the necessary documents, completing an application form, and undergoing a thorough assessment by the lender.

Mortgages for first-time as in the UK: It's important to be prepared, organised, and responsive during this process to ensure a smooth application. Make sure you have a passport or a UK driving licence which is in date, as you will need one or the other during the application. Proof of income is a significant area that will be looked at closely so ensure that you have at least three months payslips, and that there are no errors on the payslips such as your name spelt incorrectly or an incorrect address. Make sure you can obtain bank statements showing your salary credits and that you can prove your deposit. The mortgage lender will state you need to prove the source of deposit and show a buildup of funds from £0 to the balance you have now. Some mortgage lenders initially may only ask for 3 to 6 months worth of bank statements for your proof of deposit, however it's a good idea to be able to prove every penny you saved, as this may be requested later on.

Choosing the Right Mortgage Lender for First-Time Buyers

Choosing the right mortgage lender is very important for first-time buyers. It's important to compare mortgage lenders based on factors such as interest rates, fees, customer service, and their understanding of the unique needs of first-time buyers. Seeking advice from a mortgage broker can also be beneficial, as they can help navigate the market and find the best deal for your circumstances. It's not always the best option to go direct to your bank, as they will only offer you products they have available, and you could be losing out on thousands of pounds worth of savings by finding the best mortgage lenders for your circumstances. This doesn't always mean that the mortgage lender with the best rate on the market is most suited, as they may have criteria which does not fit your situation. It can be very costly making mistakes choosing the wrong mortgage lender, and it's always advisable to seek mortgage advice.

Mortgage Fees and Additional Costs to Consider

In addition to the mortgage itself, there are other fees and costs to consider when buying a home. These can include valuation fees, legal fees, stamp duty, and insurances. It's important to budget for these additional costs to avoid any surprises during the homebuying process. You may also want to upgrade your survey to either a home buyers report or full structural survey when buying your first home. Buying a property is a huge investment so it's advisable to have a more in-depth survey to ensure you are covering every base before you make that huge commitment.

Mortgages for first-time buyers: If you would like to book a free no obligation chat to discuss your mortgage options as a first time buyer, just click the link below.

Contact Alex Kerr at Mortgage Chain Ltd

Your First-Time Buyer Mortgage maybe closer than you think – start exploring your options today by contacting myself, Alex Kerr at Mortgage Chain for a free no obligation chat so we can discuss your options. Just visit our website below and click "book a free chat". I look forward to helping you!

Book a FREE Mortgage Chat here: CLICK HERE

Other resources to help you get started with Mortgages for First Time Buyers - Our YouTube Video: How to Buy Your First Home