Mortgage Brokers for First Time Buyers

We help First Time Buyer dreams become reality!

DOWNLOAD FREE FIRST TIME BUYER PACK

Want a FREE First Time Buyer Pack ?

Click below to download and discover our

FIRST TIME BUYER SECRETS to Mortgage Success.

WHAT DO MORTGAGE CHAIN OFFER ?

See below for details on all the first-time buyer services we offer.

Mortgage Broker Service

Traditional First-time buyer mortgages, shared ownership and help to buy are some of the full range of first-time buyer services we offer. First-time buyer mortgages for employed, self-employed, limited companies and contractors.

Remortgage Broker

Service

We can help first time buyers looking to remortgage for the first time as well as offering traditional remortgage services to homeowners.

Includes product transfers and raising finance via a secured loan.

Virtual Mentorship

Programme

PREPARE. APPLY. SUCCEED.

Check out our brand-new online course, first-time buyer expert, helping you prepare for mortgage success as a first-time buyer.

Onboarding

Service

If you have already had an appointment with us and would like to on-board, or if you could want to skip the initial meeting and on-board, have your documents checked and a mortgage and solicited quote recommended, faxing so you are mortgage ready use this service by clicking the link below.

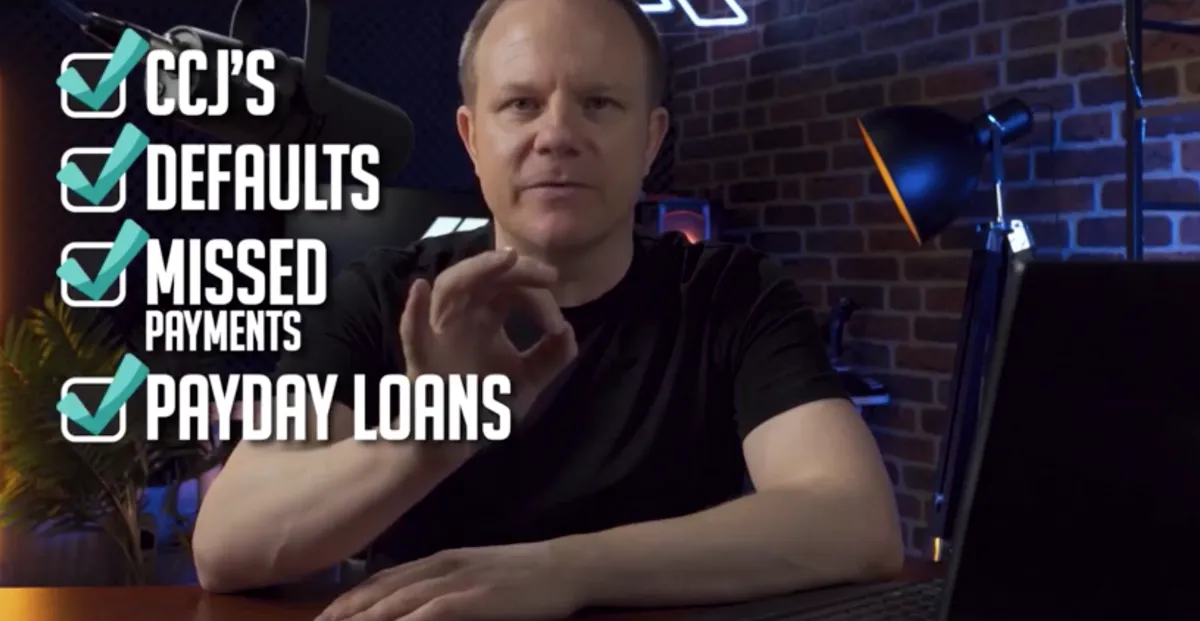

Adverse Credit ?

We are currently providing a free mentorship programme which will help you understand your mortgage options and the amount of deposit you will need for a bad credit mortgage. Click the link below to download our free online course, Bad Credit File Expert - Lite.

Full Suite of

Services

For our full suite of services we offer to first-time buyers, click on the link below. From help for non-UK nationals, buying non-standard properties, obtaining solicitor, life cover and house insurance quotes. We have it all!

WHAT DO OUR CURRENT CLIENTS SAY?

GET STARTED TODAY!

Book now to prepare, apply & succeed when applying for your first mortgage!

Latest Expert Articles...

No Deposit Mortgage | Here's How to Get One

“Unlocking Your Dream Home: Discover How First-Time Buyers Can Grab Their Mortgage with No Deposit .” - Alex Kerr

Introduction:

Are you a first-time buyer dreaming of owning your own home, but demotivated by the thought of saving up for a hefty deposit? Well, have no fear because we're here to reveal an exciting secret: you can get a mortgage with zero deposit! That's right, you can unlock your dream home without having to put down a significant amount upfront.

In this article, we'll show you how first-time buyers can make their homeownership dreams a reality by leveraging innovative mortgage options that require no deposit. We'll explore the ins and outs of these mortgage schemes, including eligibility criteria, pros and cons, and how to get started.

With the rising cost of living and the ever-increasing property prices, it's no wonder that many people find it challenging to save up for a down payment. But fear not, as the mortgage world is evolving to accommodate the needs of first-time buyers.

So, if you're ready to leave the world of renting behind and step onto the property ladder, keep reading to discover how you can get your foot in the door with a mortgage that requires no deposit. Your dream home could be closer than you think!

With that said, here are 9 reasons why you should start considering a 100% Mortgage! 👊

Understanding the concept of a no deposit mortgage

A no deposit mortgage is exactly what it sounds like – a mortgage that allows you to purchase a property without having to put down a deposit. This type of mortgage is designed to help first-time buyers who may not have a significant amount of savings to put towards a down payment.

In a traditional mortgage, mortgage lenders typically require a minimum deposit of 5% of the property's value. However, with a no deposit mortgage, you can secure a mortgage without having to save up thousands of pounds upfront. Instead, the lender provides the entire amount needed to purchase the property.

While this may sound too good to be true, it's important to note that no deposit mortgages often come with certain criteria and may have higher interest rates compared to traditional mortgages. However, for many first-time buyers, the benefits of getting onto the property ladder sooner outweigh the potential drawbacks.

Benefits of a no deposit mortgage for first-time buyers

One of the most significant advantages of a no deposit mortgage is the ability to become a homeowner sooner rather than later. Saving up for a deposit can take years, and with property prices often increasing, it can feel like an uphill battle. By removing the need for a deposit, first-time buyers can achieve their dream of owning a home much quicker.

Additionally, a no deposit mortgage can also help first-time buyers take advantage of favorable market conditions. Property prices fluctuate, and waiting to save up a deposit could mean missing out on a great property deal. With a no deposit mortgage, buyers can act quickly and secure a property before prices increase further.

Furthermore, by getting onto the property ladder sooner, first-time buyers have the opportunity to build equity in their home. As property values increase over time, homeowners can benefit from the increase in value and potentially use their equity to up-size in the future.

Eligibility criteria for a no deposit mortgage

While a no deposit mortgage may sound like a dream come true, it's important to understand that not everyone is eligible for this type of loan. Lenders have specific criteria that borrowers must meet in order to qualify for a no deposit mortgage.

One of the primary factors lenders consider is the borrower's creditworthiness. A strong credit score and a clean credit history are crucial for securing a no deposit mortgage. Lenders want to ensure that borrowers have a history of responsible financial behavior and are likely to make their mortgage payments on time.

There can sometimes be a small amount of flexibility if you've had one or two missed payments as a maximum with a credit provider, but that comes down to choosing the right mortgage lender.

Income stability is another key factor lenders look at when assessing eligibility. Borrowers who can demonstrate a stable income and the ability to afford the monthly mortgage payments are more likely to be approved for a no deposit mortgage.

Often, the mortgage lender will require to see evidence that you have been renting for at least 12 months, you are 21 years old and the mortgage payment does not exceed your current rental payment. Your current tenancy will also have to reflect the mortgage application, so if there is only one person on the tenancy, the mortgage lender will only accept an application from that person, if the tenancy is joint, then the mortgage application needs to be joint, and so on.

How to prepare for a no deposit mortgage application

Before applying for a no deposit mortgage, it's essential to prepare yourself for the process to maximize your chances of success. Here are a few steps you can take to get ready:

1. Check your credit report: Obtain a copy of your credit report from checkmyfile and review it for any errors or discrepancies. If you find any inaccuracies, be sure to dispute them and have them corrected before applying for a mortgage.

checkmyfile offer a multiagency credit report, which means all of the credit agencies that mortgage lenders used to assess your data, which is Experian, Equifax and Transunion, will all be on one file. It's quite common to have problems on one of these three credit agencies that you were not aware of, which can cause your credit score to fail with the mortgage lender.

It is vital that you check your credit score at the first step. checkmyfile is free for the first 30 days, is £14.99 per month thereafter and you can cancel at any time.

CLICK HERE to download your free copy

2. Pay off outstanding debts: Reduce your overall debt as much as possible before applying for a mortgage. Lenders want to see that you have a manageable level of debt and are not overextended.

3. Save for the related costs: While a no deposit mortgage eliminates the need for a deposit, you may still need to cover other costs associated with buying a home, such as mortgage fees and solicitor costs. Start saving early to ensure you have enough funds to cover these expenses.

4. Strengthen your employment stability: If you're currently in a temporary or unstable job situation, consider waiting until you have a more stable income before applying for a mortgage. Lenders prefer borrowers with a solid employment history and a steady income. I prefer 12 months continuous employment within the same industry.

By taking these steps, you'll be better positioned to secure a no deposit mortgage and make your dream of homeownership a reality.

Tips for finding lenders offering no deposit mortgages

Finding mortgage lenders that offer no deposit mortgages can be a bit more challenging than traditional mortgages. However, with the right approach, you can increase your chances of finding a lender who is willing to work with you. Here are a few options to help you in your search:

1. Research online: Start by conducting online research to find lenders that specialise in no deposit mortgages. Look for lenders who have positive reviews and a track record of helping first-time buyers.

4. Ask for recommendations: Reach out to friends, family, and colleagues who have recently purchased a home with a no deposit mortgage. They may be able to recommend reputable lenders and share their experiences.

3. Attend first-time buyer seminars: Many organizations and institutions host seminars and workshops specifically for first-time buyers. These events often have mortgage lenders present, giving you the opportunity to connect with them directly and learn more about their products.

4. Speak to a mortgage broker: Mortgage brokers have access to a wide range of mortgage lenders and can help match you with the ones that offer no deposit mortgages. They can also provide expert advice and guidance throughout the application process.

Mortgage Chain specialise in mortgages for first time buyers and have great relationships with mortgage lenders who offer no deposit mortgages. You can find their contact details at the end of this page.

Exploring alternative options for first-time buyers without a deposit

If you find that you're not eligible for a no deposit mortgage or you're unable to secure one, don't lose hope. There are alternative options available for first-time buyers who don't have a deposit. Here are a few alternatives to consider:

1. Using a personal loan as a 5% deposit: There are mortgage lenders that will allow you to use a personal loan as a 5% deposit. However, you must obtain the personal loan from a company that allows you to use the funds towards a house purchase and secondly the personal loan monthly payment must be factored in to the budget planner and your income must be able to afford the loan payment within the affordability check. If you meet these criteria is then using a personal loan as a deposit is an option.

2. Shared ownership: Shared ownership schemes allow you to purchase a percentage of a property and pay rent on the remaining share. This can be a more affordable way to get onto the property ladder without a deposit as the minimum deposit is only a quarter of the deposit you would normally need to put down, when buying a property outright, as with shared ownership you can purchase a share starting at just 25%.

So if you are purchasing a property for £300,000, with a 25% share, which means the share you are buying is costing £75,000, the deposit required is just £3750, compared to £15,000 if you are buying the property outright.

This can be fantastic alternative, and many first-time buyers use this as a steppingstone onto the property ladder.

3. Joint borrower Sole proprietor mortgage: This mortgage product allows you to obtain a joint mortgage with a family member. The mortgage lender will take both of your incomes into account, however the joint borrower will not go onto the deeds of the property, and therefore they will have no ownership rights. It is worth noting that the joint borrower cannot live in the property and will need to be able to afford their own home expenses and the expenses related to the property being purchased. If the criteria fits this can be a great way of getting onto the ladder.

4. Family guarantor mortgage: If you have a family member willing to act as a guarantor, you may be able to secure a mortgage with a smaller deposit. The guarantor provides additional security for the lender, allowing you to borrow a higher percentage of the property's value.

Each of these alternatives has its own set of eligibility criteria and considerations. Research each option thoroughly and speak with a mortgage advisor to determine which one is the best fit for your circumstances.

The application process for a no deposit mortgage

Once you've found a mortgage lender offering no deposit mortgages and have determined that you meet the eligibility criteria, it's time to start the application process. Here's a general overview of what you can expect:

1. Initial chat: You'll typically start with an initial consultation with the lender or mortgage broker. They will assess your eligibility, discuss your financial situation, and answer any questions you may have.

2. Onboarding process: You'll need to gather all the necessary documentation and paperwork to support your mortgage application. This may include proof of income, salary credited bank statements, identification documents, proof of address and proof of deposit.

3. Credit check and affordability assessment: The lender will conduct a credit check to assess your creditworthiness, verify your ability to afford the mortgage payments. They may also ask for additional information or clarification during this stage.

Once you have passed the credit check, you will be provided with evidence. This process is known as obtaining an agreement in principal. You can show this evidence to an estate agent when it's time to view properties, to show that you are mortgage material and have had this check carried out.

4. Basic valuation: The mortgage lender will arrange for a basic valuation of the property you wish to purchase to ensure it's worth the amount you're borrowing.

5. Mortgage offer: If the lender is satisfied with your application, they will issue a mortgage offer outlining the terms and conditions of the mortgage. Review the mortgage offer carefully and seek legal advice if needed.

6. Legal process and completion: Once you've accepted the mortgage offer, the legal process begins. This involves conveyancers (property solicitors) handling the necessary paperwork and transferring ownership of the property. Once the legal process is complete, you'll be the proud owner of your new home!

Common challenges and misconceptions about no deposit mortgages

While no deposit mortgages can be a great option for first-time buyers, there are some common challenges and misconceptions to be aware of. Here are a few:

1. Higher interest rates: No deposit mortgages often come with higher interest rates compared to traditional mortgages. This is because mortgage lenders are taking on more risk by providing a mortgage without a deposit. However, with careful financial planning and timely mortgage payments, you can refinance your mortgage in the future to secure a lower interest rate.

2. Limited mortgage options: Not all mortgage lenders offer no deposit mortgages, so your options may be more limited compared to traditional mortgages. It's important to do thorough research and consider alternative options if you're unable to secure a no deposit mortgage.

3. Stricter eligibility criteria: Mortgage lenders have stricter eligibility criteria for no deposit mortgages to mitigate the risk. It's crucial to have a strong credit history, stable employment, and the ability to afford the monthly mortgage payments to increase your chances of approval along with a history of paying rent without any missed payments.

4. Potential negative equity: With a no deposit mortgage, there's a risk of negative equity if property prices decrease. Negative equity occurs when the outstanding mortgage balance is higher than the value of the property. However, as property values tend to increase over time, this risk can be minimised with a long-term mindset.

By being aware of these challenges and misconceptions, you can approach the process of obtaining a no deposit mortgage with a realistic outlook and make informed decisions.

Conclusion: Empowering first-time buyers to achieve their dream home

Owning a home is a dream that many first-time buyers share, but the thought of saving up for a deposit can be discouraging. Fortunately, the mortgage landscape is evolving to cater to the needs of first-time buyers, and no deposit mortgages are becoming more accessible.

In this article, we've explored the concept of a no deposit mortgage and the benefits it offers to first-time buyers. We've also discussed the eligibility criteria, how to prepare for an application, and alternative options for those who may not qualify for a no deposit mortgage.

Remember, getting onto the property ladder without a deposit requires careful planning, financial discipline, and thorough research. By taking the necessary steps and seeking professional advice, you can unlock your dream home and achieve your goal of homeownership.

Contact Alex Kerr at Mortgage Chain Ltd

Your dream home may be closer than you think – start exploring your options today by contacting myself, Alex Kerr at Mortgage Chain for a free no obligation chat so we can discuss your options. Just visit our website below and click "book a free chat". I look forward to helping you!

Book a FREE Mortgage Chat here: CLICK HERE

Other resources to help you get started with no deposit mortgages - Our YouTube Video on 100% Mortgages!